Getting to the root of settlement fails

The securities industry has made strong progress on increasing straight-through processing (STP) rates in the post-trade settlement and reconciliation area over the past decades. However, securities settlement inefficiencies (including settlement fails) still account for a direct loss of about USD 3 billion every year to the industry.

Some markets have reached higher efficiency rates than others, mainly thanks to local efforts. But cross-border transactions can still benefit from more efficient and smarter settlement processes to reduce inefficiencies and costs. This has become even more paramount as major markets, with high foreign investments, are embracing a shift to shorter settlement cycles (T+1).

Improve settlement efficiency

Swift Securities View has been developed with the capital markets community to enable two-sided end-to-end tracking throughout the lifecycle of a securities settlement transaction. This increased transparency helps you detect data discrepancies and identify trades at risk of failing so you can correct issues before they become a problem. As a result, you benefit from reduced operational risk and costs, improved STP and better settlement efficiency.

The service reduces the total industry cost of securities settlement and helps you avoid regulatory penalties and better manage your liquidity and securities positions.

Swift Securities View offers API integration channels so you can integrate the settlement transaction data via a machine connection.

About Swift Securities View

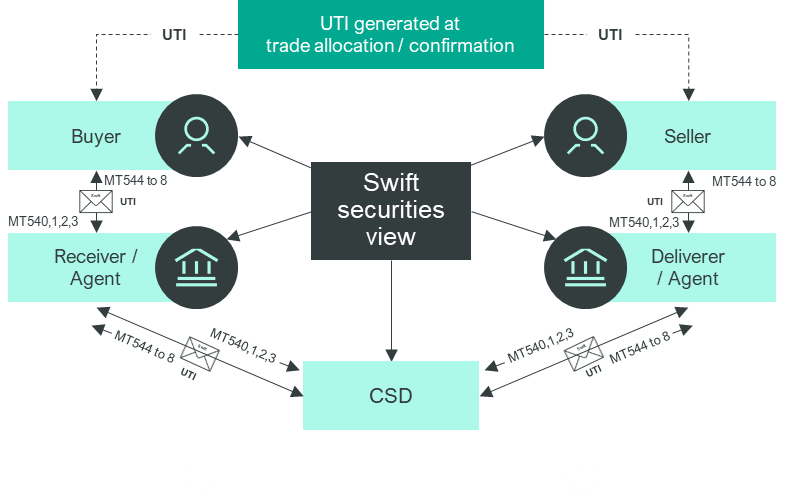

Swift Securities View provides visibility on securities settlement transactions. It leverages the settlement data carried on the Swift network including ISO 15022 MT messages. The service consolidates settlement data to power an end-to-end, two-sided, neutral view on securities transaction across the chain of participants, providing real-time information on its lifecycle and latest processing status.

Users can access the service’s data and functionalities through various integration options including API endpoints. The Securities View notification API provides a mechanism for users to receive event triggers and updates supporting greater visibility on the end-to-end securities settlement transaction flow. A service user can subscribe for service notifications. The notification criteria can be set individually for every organization (BIC) with multiple conditions. Notification criteria is evaluated when a change (new/update) occurs on the transaction state. Notification(s) will be generated for participants when the event corresponds to user's criteria. The notification returns transaction identifier with corresponding timestamps and notification reason.

Supported Developer Toolkit

This API will be supported by Swift SDK and Swift Microgateway.

Ordering and Provisioning

Become a securities view member and subscribe to the securities view service to start using the APIs. Order now.